If you are like many mid to large size employers, your health insurance experience has been one of frustration because of unmet expectations, such as the ones listed below.

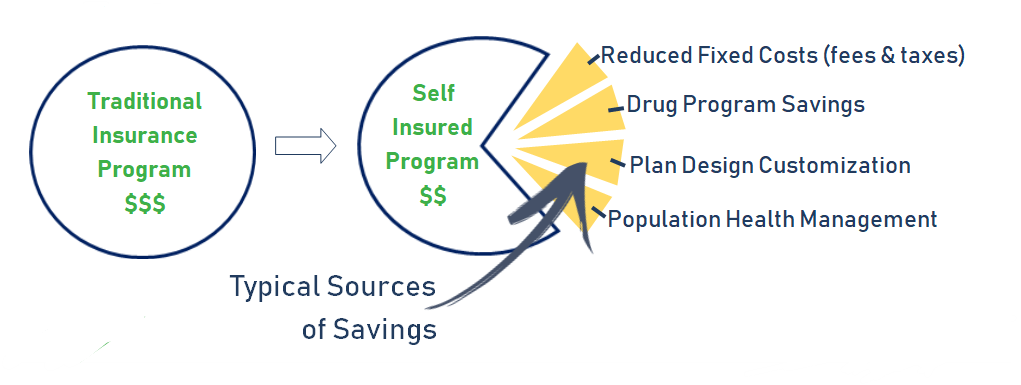

Self funding puts you behind the wheel of your health insurance program, one that’s custom-fit to your strategic initiatives and unique workforce dynamics.

Companies in self funded health insurance arrangements pay

less on average than their fully insured counterparts due to eliminated fees & taxes alone.

Typical sources of savings are through lower admin fees, elimination of carrier pooling charges, claims run-out margin, exemption from fees and taxes that only apply to fully insured programs, drug program PBM, plan design flexibility, stand alone or captive stop loss programs and robust population health management solutions.

Budget Stability through setting appropriate stop loss levels

Plan solvency through proactive cash reserve build-up

Robust claims mgmt. partnerships (i.e. diabetic concierge services) with measurable ROI

Advanced data mining and predictive analytics

Dashboard views of health plan performance with actionable insights

Prescription Drug Program Transparency

Wellness & Benefit Program Tools that engage & empower your employees

Vendor Performance Guarantees

Carefully managed Stop Loss through individual or captive programs